Shopping at AnyoneGo

AnyoneGo is a technology company with headquarters, design team and all production located in the Czech Republic.

So if you order from our e-shop, you order products from the Czech Republic – the European Union. All warranties, delivery times or VAT are thus in accordance with the applicable European legislation.

Thanks to the fact that we are located in the heart of Europe, you can be sure that any questions or problems will be resolved within normal working hours without unnecessary delays. We are at your disposal at support@anyonego.com, you can also contact us via FB chat directly from our website or connect with us on our other social media accounts.

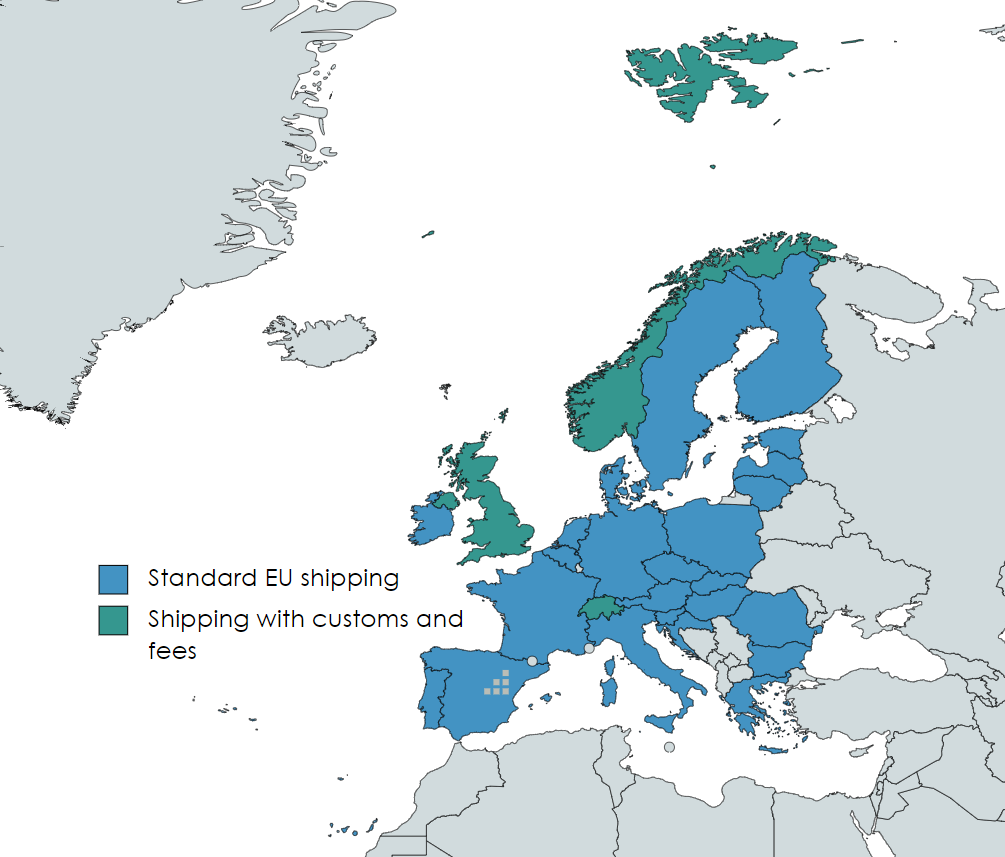

Currently we ship to all European Union countries:

Austria, Belgium, Bulgaria, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lithuania, Latvia, Luxembourg, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

We are also able to deliver your wheelchair, drag bag or other product to the United Kingdom, Switzerland and Norway. For these cases, please read the following information on export outside European Union.

The whole AnyoneGo team wishes you pleasant shopping! We are here to help you and your dog the best we can.

General information on export outside EU:

Shipping to certain countries outside EU is subject to local taxes and customs. Generally, we are responsible for making sure that the product is packed and marked properly, and that it leaves EU. The customer may be liable for customs declaration and VAT or sales tax payments, however we do our best to arrange for all duties so that you know in advance the final price that you pay.

The information about customs duties in our e-shop may not be accurate due to recent changes, different assessment of local customs authorities, and volume/weight of the shipment that has impact on transportation costs and price thereof.

We will always include an invoice (full, non-simplified), the invoice can be in paper or digital form.

Customs declaration:

Customs duties are indirect taxes that are levied on goods that are brought into the country‘s customs territory. They can also be called border tariffs. The collection of customs duties is based solely on specific assessment bases (value or gross weight).

When importing our goods, the buyer has to declare the goods, its value and weight/volume. When levying the customs duty, most countries follow the valuation method CIF, which stands for Cost, Insurance, Freight, exactly as EU countries (CIF Value = Cost of goods and tools + Delivery to the port of loading + Export clearance + Shipping to the port of destination + Insurance).

Value added tax (VAT):

VAT is levied on all imports of goods, even on consignments with “no value”.

Our e-shop prices are displayed as inclusive of CZ VAT (21%) and will be adjusted to the local VAT rate of customer’s country at checkout if you enter a non-EU delivery address.

Unless agreed otherwise, AnyoneGo delivers the goods to your location, and arranges for custom duties and VAT. If you wish to arrange for import by yourself, let us know. For this purpose, the shipment receives its unique MRN number (movement reference number).

VAT is calculated as follows: VAT rate*(Customs Value + Duty Rate).

Please note that a definitive calculation may not possible, as the costs of the transporter might not be known in advance. The costs are generally billed to the recipient together with the customs duty and taxes (e.g. VAT).

We will do our best to deliver you the goods free of any additional charges (duties, VAT). Exact information will appear at checkout.

If the delivery address is in Norway:

Please DO NOT use e-shop for ordering our products if you are from Norway. Contact us via e-mail (support@anyonego.com) with your request instead.

We can ship to Norway, but according to our experience with VAT/custom procedures it is best to arrange all the details of the order outside the e-shop.

Nor AnyoneGo nor shipping companies in the Czech Republic are able to collect Norwegian VAT. Therefore, we have to prepare special price offer/overview for you.

You will pay price for the goods without the VAT to us (invoice from AnyoneGo with 0 % VAT) and mandatory VAT (25 %) as soon as the parcel reaches Norwegian customs.

25 % VAT is paid directly to Norwegian administration and when you order from AnyoneGo you are under obligation to discharge this tax in line with instructions from your local authorities.

To the best of our knowledge, our products are subject to 0% import customs duty (HS code 8716800000)

We will also try to find the most advantageous courier according to your order, as the price may vary significantly based on weight and measures of the final parcel. We want you to know the shipping costs in advance as accurately as possible.

Self-import:

If you decide to arrange for transport and customs duties by yourself, please let us know before checkout. This may be reasonable especially in cases where you buy larger volume of our products or if you are a business and buy for further resale.

If you arrange for own transport, our supply will be accomplished by handing over to the shipping company that you chose (EXW). We would be responsible for proper marking and packing.

Generally, our goods fall under HS commodity code: 8716800000 (VEHICLES, AIRCRAFT, VESSELS AND ASSOCIATED TRANSPORT EQUIPMENT – Vehicles other than railway or tramway rolling-stock, and parts and accessories thereof, Trailers and semi-trailers – other vehicles, not mechanically propelled; parts thereof – Other vehicles: not fitted with suspension or pneumatic tyres) but you should double-check this classification.

We will mark the package properly, ie. we won’t declare that it is a gift, and we will state the actual value.